Our Money Month Webinars

Pillars of Financial Success: Resilience in Retirement

Financial Adviser & Coach Karen Beckham

Pillars of Financial Success: Wealth Resilience in Uncertain Times

Financial Adviser & Head Coach Katie Wesney

Pillars of Financial Success: Beat Debt, Build Financial Resilience

Financial Adviser & Coach Kirsty Healey

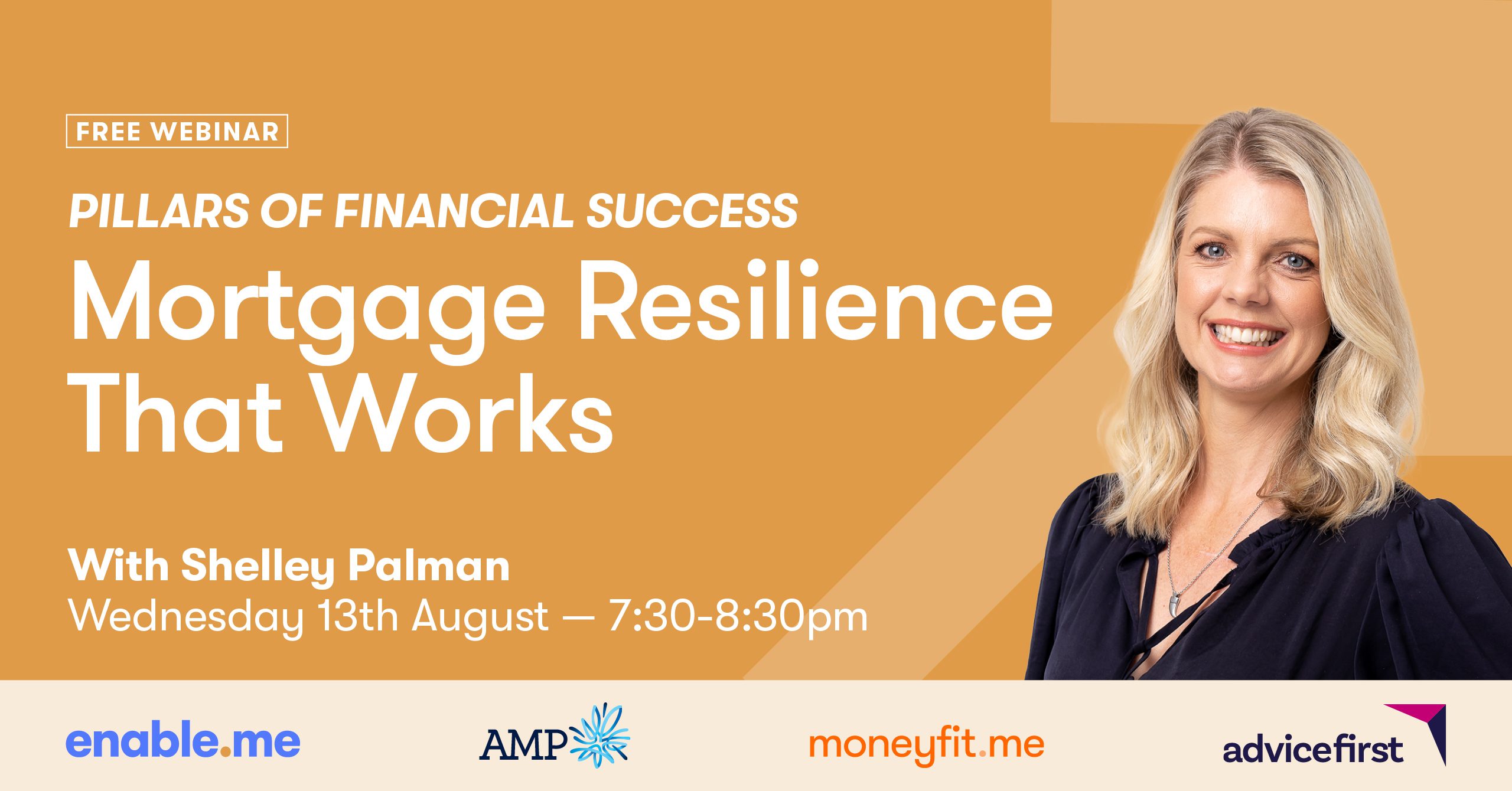

Pillars of Financial Success: Mortgage Resilience That Works

Financial Adviser & Coach Shelley Palman

Where Can You Find Little Wins Today?

We’ve broken down six key areas where Kiwis spend the most – and where even small changes can add up. Each tip sheet offers quick, practical ideas to help you stretch your budget and reduce financial pressure. Enter your details to download your ‘Little Wins’ tip sheets:

*By filling out and submitting this form you, are consenting to be contacted by enable.me about this eBook and relevant marketing communications.

Start Building Your Resilience

Track Your Spending. Build Better Habits. See Real Progress.

Get started with the moneyfit.me Tracker, our powerful app that helps you track your spending, spot patterns, and make small changes that stick. Because the Little Wins add up.