If you’ve been following the news lately, you may be feeling a slight sense of angst and worry. At the time of writing this article, we’ve seen imposed tariffs, more tariffs, market volatility and THEN tariffs on ‘pause’…? Suffice it to say, these headlines may send our confidence in the global economy into a tailspin.

It’s important to note that headlines are designed to be polarising. They’re designed to elicit a visceral response to make us immediately jump to click and read and crave more and doom scroll and so on and so forth. This makes it harder for us to do what many financial advisers are currently recommending: to not worry.

We get it. So, before we dive into today’s article, let’s all *pause*, take a deep breath (no, seriously, have you taken a breath?) so we can continue to read from a place of ease and equanimity.

Why most of us will be ok

Most of us, and our finances, will make it through this time. But there’s a caveat to this.

If you’ve been investing on a long-term trajectory (10 or more years) in high-risk, high-growth investments, and you’ve chosen to do nothing at all, it’s likely your investments should be okay.

Why? Because in times of economic turmoil, markets do recover. This time is no different. The most important question to ponder, however, is: How long will they take to recover? That, we do not know. Which is why having a diversified portfolio is paramount to the success of your wealth creation strategy, as well as having an appropriate risk-mitigation strategy for your time horizon.

To prove a point, let’s take a trip back in time to see how the financial markets weathered previous tumultuous economic times.

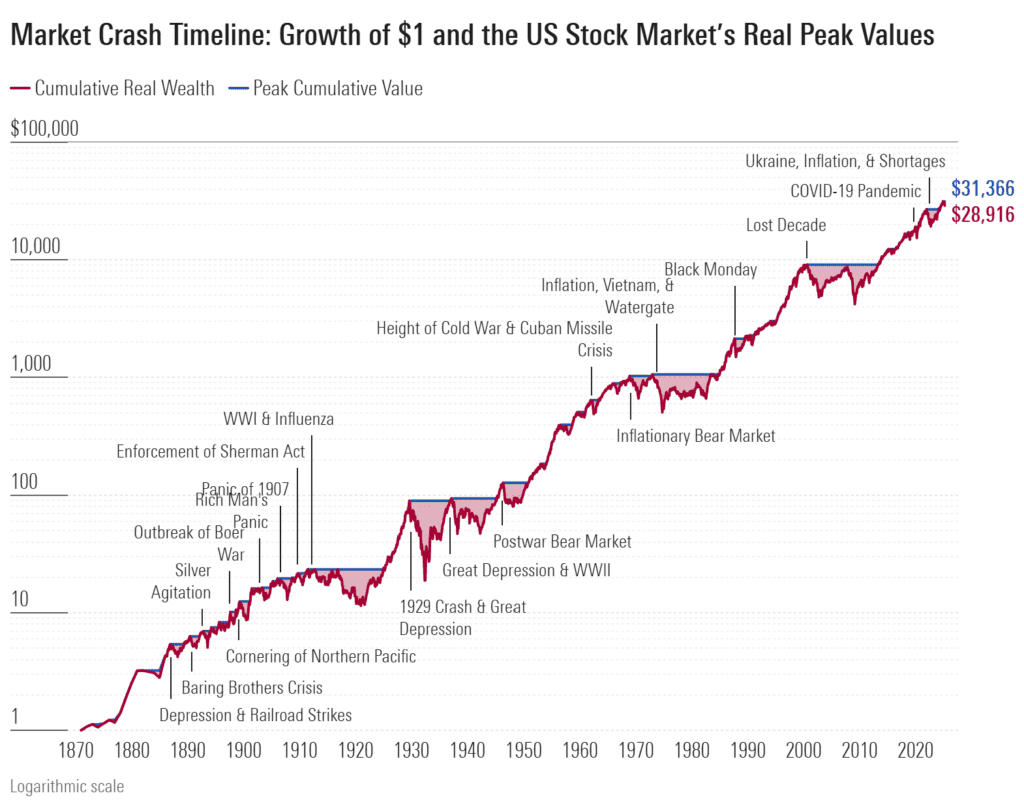

Over the past 150 years there have been roughly 19 market crashes along the way*. Analysts define a market crash (also known as a bear market) where markets fall by 20% from the historic peak of its time. You can view the Morningstar graph below to see these market crashes:

Despite the scary dips along the way, you’ll see in this graph a common trend; following a market crash, the markets recover and continue to go up.

The 2020 pandemic market crash was a severe one, but fast. The Dow Jones (a stock market index with 30 most prominent listed US companies) saw a dip of 37% between February and March 2020, but recovered from its lows by November 2020. Only those who sold during that time would have realised an actual loss.

With all things considered, not all stars are aligned, and we did mention a caveat earlier. You may want to review your investment strategy if:

- Your time horizon has changed. For example, if your KiwiSaver investment is placed in a growth fund, but you’re looking to access your funds sooner (1 – 2 years) for a first home deposit or retirement.

- Your personal circumstances have changed.

- Your investment values have changed.

- You’re concerned whether your portfolio is diversified enough.

- You have no investment strategy to begin with.

For those who are investing for the long term (10+ years), who have a diversified portfolio, who are comfortable with the risk they are taking, this article is probably a long-winded way of saying ‘do nothing’. But know you can always call on an expert to alleviate the nerves and provide reassurance around whether your wealth creation strategy is still appropriate for you.

If you want to harness the power of accountability and financial coaching, book a consultation with enable.me today and take control of your financial future.

Disclaimer: This blog post is for informational purposes only and does not constitute individual financial advice. If you’re interested in receiving financial advice, you can book a consultation with an enable.me coach. Costs apply.

References:

*Morningstar