Do you think of your mortgage as a rather inconvenient debt? The literal price you have to pay for the privilege of living in your ‘own home’. It’s not an unjustified thought.

Depending on what the interest rates are doing, you may end up paying over double what you borrowed back to the bank over a 30-year mortgage term. Money that – if you have the right strategy in place – you could instead use to grow your wealth.

Because, while yes, your mortgage is a debt you have to pay off, having a mortgage also provides you with opportunities to grow your wealth – if you know how to use it.

So, how could you use your mortgage to grow your wealth?

The reason that your mortgage can help you grow wealth is that it’s considered ‘good debt’. Good debt is associated with assets that appreciate in value over time. Like property.

(Bad debt on the other hand is associated with assets that depreciate in value, like technology and most cars).

So, you can use the fact that mortgage debt is good debt to your advantage.

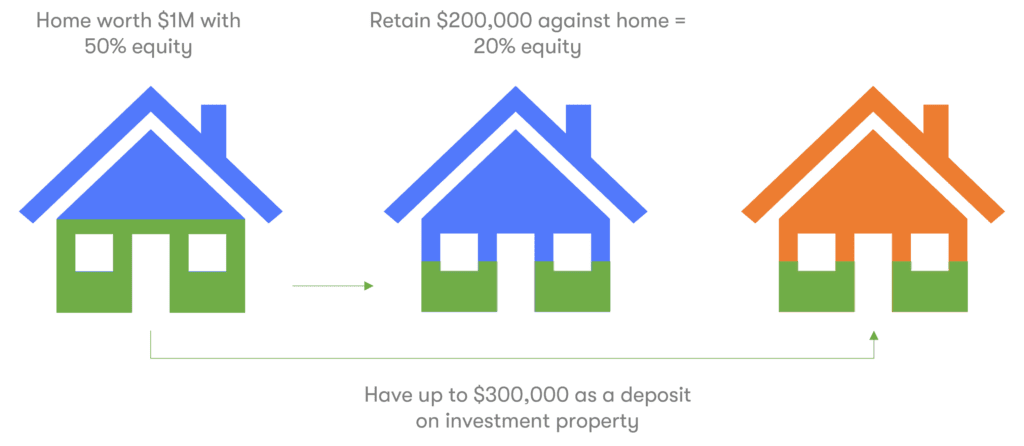

Banks are quite happy to lend you money to purchase an appreciating asset like a house (if you meet their serviceability criteria at least) because they know that even if you default on the mortgage, they can get their money back by selling it. And they’re generally quite happy to continue to let you borrow against your home as long as you continue to have at least some equity against it. Most banks require you to hold at least 20% equity in the home you live in.

This means that if you have built up more equity than that, you could potentially use that extra equity as a deposit for an investment property.

The great news is that you don’t need to wait until you’ve fully paid off your mortgage to use a portion of it to purchase an investment property. You just need enough to leave the minimum required by the bank against your home, and have enough to cover a deposit on the investment property.

(You’ll also want to make sure you have enough surplus cash to pass bank serviceability criteria, but that’s a story for another day.)

But, what if I don’t want to invest in property?

If buying an investment property isn’t your thing, there are still ways you can manipulate it so that you have the ability to grow your wealth over the long term.

The way we help people achieve this is by finding ways for them to pay off their mortgage faster (which consequently, is also a great way to quickly build up equity in your home to then use as a deposit for an investment property, but I digress).

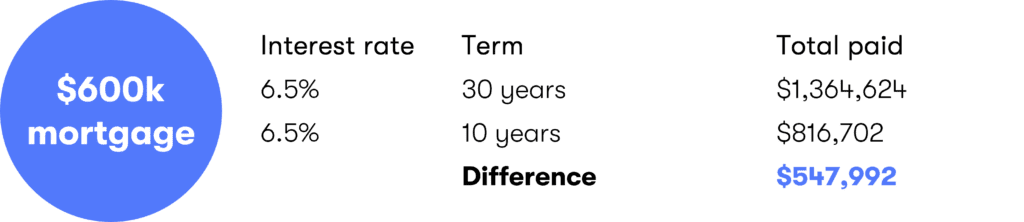

By paying off your mortgage faster, you’ll pay back less to the bank overall. The difference between paying off a $600,000 loan at 6.5% over 10 years instead of 30 years, for example, is $547,992*

This ~$500k is then available for you to contribute to an investment, like a managed fund. You’ll also have more time for that investment to grow as you’re able to contribute money towards the investment instead of paying off slowly, bit by bit, paying off your mortgage.

So, while your mortgage may feel like a drain on your finances, it’s also a great tool you can use to help you grow your wealth. As you build equity in your home by paying off the mortgage (and as it appreciates in value) you have the option to leverage some of that equity to buy an investment property. And, if you’re on track to pay off your mortgage faster than 30 years, you’re building that equity up faster, saving money you’d otherwise pay to the bank, which is money you can then invest and use to grow your wealth.

Want to talk to an experienced financial adviser about how you could use the equity you’ve built up in your home to fund an investment property, how you could pay off your mortgage faster, or where you could invest surplus cash to grow your wealth, book a consultation with an enable.me financial adviser today.

Disclaimer: This blog post is for informational purposes only and does not constitute individual financial advice. If you’re interested in receiving financial advice, you can book a consultation with an enable.me coach. Costs apply.

*Using the Sorted Mortgage calculator. The rate at which you could pay off your mortgage depends on your financial situation – how much debt you have and how much surplus cash you have to divert towards your mortgage. Interest rates may change, which will also impact how much you pay to the bank for the mortgage – so true figures will vary from example.