From the moment you’re born, progress is measured in milestones. Your first step. Your first word. Your first day at school. As life unfolds, these milestones start taking on different forms and, often, there’s a significant financial element involved – think buying your first home, going on an O.E. – or even having your own kids!

Your financial position can often make or break these experiences – buying your first home, for example, is a lot more difficult when you still have debts you’re paying off and you haven’t been able to save for a deposit.

Therefore, having a strong financial foundation is key when it comes to achieving any major milestone. It gives you something you can leverage – whether that’s getting on the property ladder, growing your wealth, planning for retirement, or something else – and it can protect you in the event something goes wrong.

What are these foundations you’re talking about?

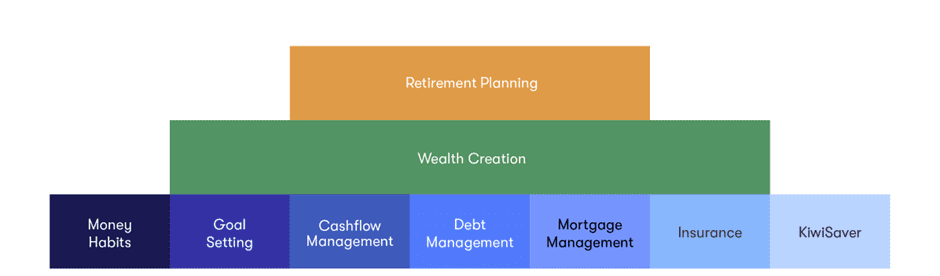

At enable.me, there are 7 key pillars that make up the financial foundations.

These are:

- Your money mindset and how this influences your tendencies to spend or save

- Having goals in place so you have something to motivate you

- Managing (and paying down) short-term debt

- Your cash flow management (and having a financial buffer)

- Your mortgage structure – allowing you to pay it off faster, without removing flexibility in your financial plan

- Making sure you have the right type and level of insurance, and

- Maximising your KiwiSaver

Having these foundations in place means you can then move on to the next step in your financial journey – creating wealth and preparing for retirement. It can also mean the difference between going backwards or holding steady if an unexpected event impacts your financial situation, such as divorce, illness or redundancy. Having that foundational layer sorted is a crucial part of your future financial security.

So, why is your financial foundation so important?

It Unlocks Your Cash Surplus so you can Grow Wealth

Imagine you no longer had any debt repayments to worry about, you’ve set up an emergency fund, and you’re no longer buying lunch when you have perfectly good food at home. What could you do with that extra cash that’s now burning a hole in your pocket?

While you could go on a shopping spree a more future-focused option would be to put that money to work by investing it. When all your costs are covered, putting money into a long-term investment – whether that’s in property, managed funds, or something else – won’t seem as scary, or have as big of an impact on your ability to enjoy your day-to-day life.

Your Financial Foundation gives you options

A lot of the time when we work with clients, they tell us that their goal is to have ‘financial freedom’. Financial freedom can mean different things to different people, but we tend to translate it into having options. Options for how you live, for how you balance work and life, the option to retire early, or the option to build a legacy or help your family.

When you have your financial foundation in place, it becomes a lot easier to choose when, where, and what you do with your money.

If you’re no longer living pay-cheque to pay-cheque, paying down credit card debt, or tied to a large mortgage, it makes it easier to go through with a career change, take an extended holiday, change where you live, or even retire early – because you’re no longer relying on that income just to survive.

So, in a way, your Financial Foundation acts as Your Safety Net

Your foundation also acts as an extra layer of security, a little safety net. In the event something goes wrong, there’s something to catch you and make it easier to bounce back.

Insurance is a useful example. When we insure our car, home, and contents we feel safe that if something were to happen, the hit on our finances is going to be a lot less. Similarly, health insurance means that if we get sick – there’s a good chance the majority of the costs will be covered, while trauma, income, and life insurance can protect us and our family if something more major were to go wrong.

In the same way, having that financial foundation (which includes having appropriate insurance in place) means that in the event something happens – like you were made redundant, or lost your income for another reason – there’s a safety net there. An emergency fund you can use while you look for a new job without going into debt, habits that mean you won’t spend money on new clothes rather than paying the bill. These events then become a minor bump in the road, rather than something that will knock you completely off track.

And if you’re lucky enough that life doesn’t throw any curveballs your way, then having this financial foundation in place will make reaching life’s milestones all the easier.

Need help establishing your foundation? Book a consultation with an enable.me coach and they can assess your current financial position, identify where it can be strengthened, and recommend a plan of action to secure your financial foundation. Book your consultation today for just $249*. Click here

Disclaimer:

This blog post is for informational purposes only and does not constitute individual financial advice. If you’re interested in receiving financial advice, you can book a consultation with an enable.me coach. Costs apply.